Stepping away from the junior mining world, a quick glance at the interesting dynamics that make up the complex world of international shipping. While everyone probably already heard of some of the issues and/or experienced some of the consequences (higher prices and/or long delivery dates). My personal additional trigger to dig in a little deeper came after reading ‘The shipping man’, a fictitious novel packed with wisdom about the shipping business (tankers, not cargo vessels), an extremely volatile market. Recommended read.

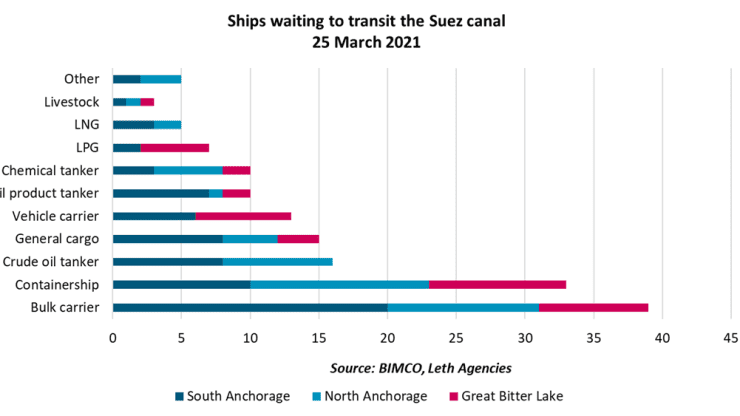

Breaking: Suez Canal is blocked (24/03/21 -…)

Covid implications

While the service economy has been “heavily impaired” by COVID and remains so, goods demand is growing both at the expense of services as well as due to “tremendously supportive fiscal policy.”

“Goods demand is now 6% higher than it was prior to the pandemic. We’re seeing a similar trend in the housing market, for both new and resale markets.

“We’ve had this surge in demand and the supply side of the economy has not kept up. This is both because of supply chain disruptions and because producers, retailers and home builders were just caught off guard.

“Nobody anticipated demand to be this strong this quickly. As a result, we have inventory-to-sales [I/S] ratios today that are at absolute record lows.

China is sending out a lot more exports to the U.S. and Europe than the other way round. Its economy bounced back faster as the virus situation within its borders was basically under control by the second quarter of last year. As a result, containers are stuck in the West when they are really needed in Asia.

The Chinese are being so aggressive about trying to get empty containers back, that it’s hard to get a container for US exporters. 3 out of 4 containers from the U.S. to Asia are “going back empty.

In fact, the container shortage in Asia has also led to a similar crisis in many European countries, such as Germany, Austria and Hungary, as shipping carriers redirect containers to the East as quickly as possible.

“It’s not really a shortage. It’s more that the containers are out of position” – Ocean Audit founder Steve Ferreira

In December, spot freight rates were 264% higher for the Asia to North Europe route, compared with a year ago, according to Mirko Woitzik, risk intelligence solutions manager at supply chain risk firm Resilience360. For the route from Asia to the West Coast of the U.S., rates are up 145% year over year.

The timing of the lock downs in the various parts of the worlds didn’t help either. While China went in lock down, many Western companies weren’t getting their deliveries from China, then when China came out of lock down & wanted to order and deliver, Europe and/or America went into lock down, creating the largest trade imbalance ever seen.

E-commerce continues to push imports higher

Yet another reason for the intense strength in the trans-Pacific eastbound trade is the COVID-induced shift from in-store to e-commerce sales.

“Since the start of the pandemic in the U.S. in early March, there has been a seismic shift in e-commerce activity. It is estimated that at least four to six years’ worth of e-commerce sales growth was pulled forward into 2020.” – According to Matt Cox, Matson CEO

“We are just at the beginning of what is likely to be one of the biggest restocking cycles — if not the biggest inventory restocking cycle — in U.S. history,” maintained Jefferies Chief Economist Aneta Markowska

It is estimated that at least four to six years’ worth of e-commerce sales growth was pulled forward into 2020.” – Matson CEO Matt Cox

Stimulus checks

According to the volumes of trade transported by SEKO US, there is a direct correlation to the stimulus checks and the surge in e-commerce spending.

“The combination of the shift of e-commerce driven by COVID and stimulus checks is what drove order volumes in December to January 2021 and February to March 2020,” explained Brian Bourke, chief growth officer of SEKO US. “Anything that shows an increase month-over-month versus year, as we saw in December to January, is most likely attributed to the stimulus checks.”

US & China

The pandemic has been a boon for Chinese exports and showcases the United States’ dependency on Chinese manufactured goods. In January and February of this year, Chinese exports have increased an incredible 60.6% compared to 2020. December saw growth of 18.1%, according to Chinese customs.

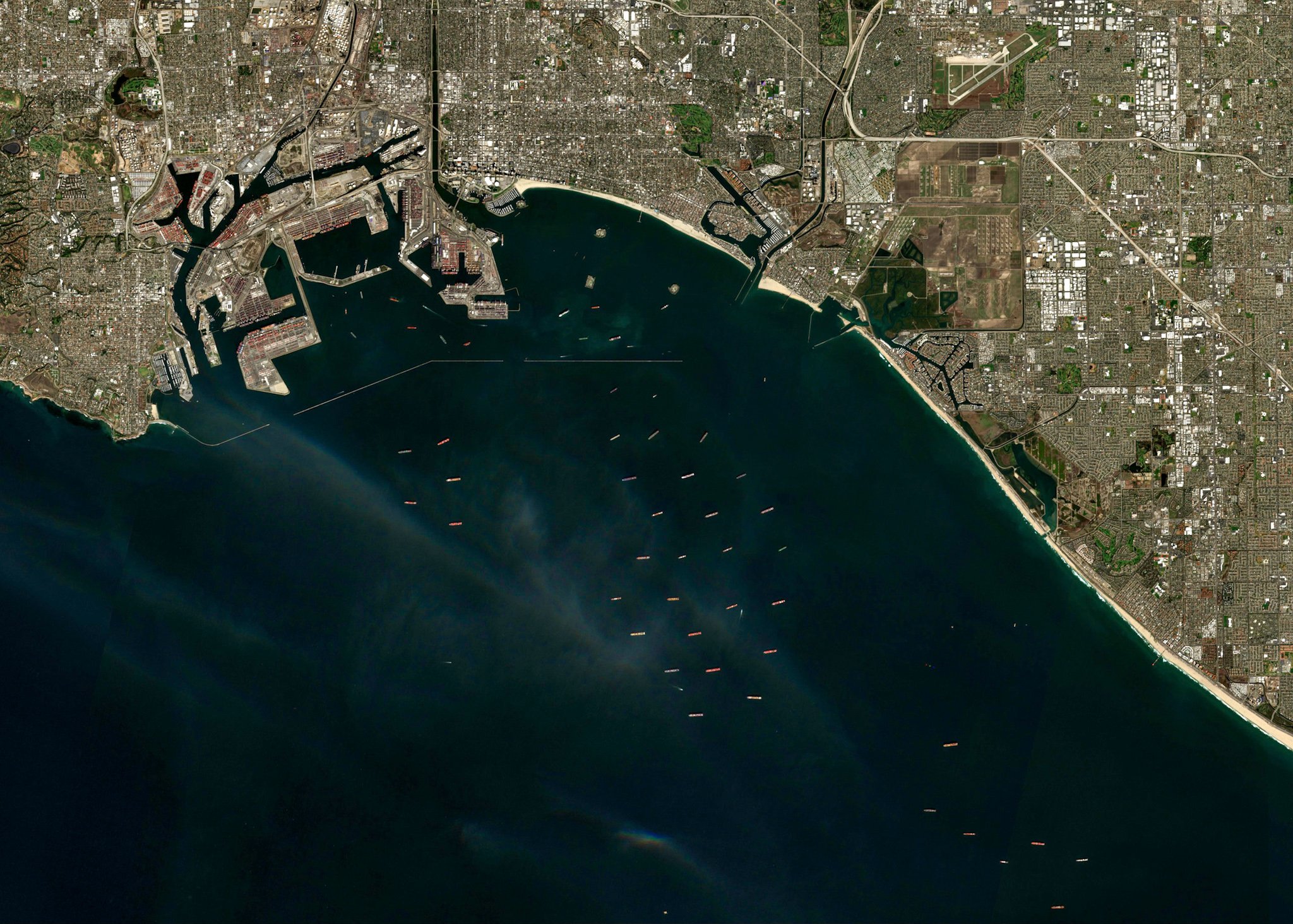

Port of Los Angeles loaded container import- export imbalance hits 4:1, one of the highest levels ever seen at the port of Los Angeles. Meanwhile the export of empty containers soared 104.4% year-on-year. The lob-sided trade imbalance we are witnessing is now at historic levels. Recent studies report that at the port of Los Angeles in December 2020, loaded imports were up more than 23% year over year, creating a dwell time of greater than five days. Last month (February 2021), close to 50 ships anchored outside the port, awaiting berth.

Shippers can’t get all their cargo to the U.S. if liners don’t have not enough empty boxes in China.

As containers pile up at sea terminals, cargo owners are paying the toll. Vessel operators continue to dole out detention charges, the fees paid for using a container outside of the port beyond a free allowable period, even when marine terminal operators have no room for empty containers.

Meanwhile, truckers are waiting hours for port access, and as a result, forwarders and shippers are incurring significant charges for their time. Ocean carriers seem to be benefiting from a problem that they are causing…

Container availability China

“With so many supply chain disruptions still evident, expectations are that container availability in China and elsewhere are to remain volatile. But thus far in 2021 there are positive signs that availability at key export hubs is improving.

One week of index values greater than 0.5 does not mean so much but exceeding the 0.5 marks for several weeks in a row like Shanghai and other main ports in China have done means that finally more containers are entering ports regularly, giving them the chance allow the container supply/demand imbalance to reduce

A CAx reading below 0.5 means more containers leaving a port than entering it, while a reading above 0.5 means more containers entering than leaving;

Schedule Reliability

Global container line schedule reliability plunged to just 34.9% in January 2021 as container carriers continue to grapple with a combination of a sharp surge in demand, shortage of equipment and port congestion on the US West Coast.

Freight prices

The increase in freight prices will add further pressure on retailers who are already dealing with higher costs as a result of Brexit and COVID. Freight prices to bring goods into the U.K. from France and Germany — two of Britain’s largest trading partners in Europe — were up 50.5 percent and 31 percent, respectively, in January 2021 compared to the same month a year before, new figures from Tim Consult Transport Market Monitor show.

The shortage is a result of the demand for shipping during the pandemic as people have bought up goods for home improvements, furniture and tech for their new home offices. Combine that with all the personal protective and medical equipment flowing through the global port system and you have a recipe for bottlenecks and backlog.

Container prices

Making matters worse, orders for new containers were largely canceled during the first half of last year (2020) as most of the world went into lock down, according to Alan Ng, PWC’s mainland China and Hong Kong transportation and logistics leader.

“The magnitude and pace of the recovery have caught everyone by surprise,” he said. “The sudden recovery in trade volume has seen virtually all of the major shipping lines needing to add significant container capacity to address the container shortage issue.”

Chipageddon

On 17/03/21 Samsung held its annual shareholders’ meeting in Suwon, South Korea. The co-CEO DJ Koh revealed to investors the company is considering skipping the introduction of a Galaxy Note smartphone in 2021 due to a “serious imbalance” in semiconductors globally.

Suffering from poor sales, car manufacturers cut their orders from the Chinese factories making computer chips. In response, the chip supply from factories was transferred to other sectors that had high demands.And unable to retrieve cancelled orders when demand for cars grew, Volkswagen, Honda, Toyota and General Motors all had to reduce production.

Quilter Cheviot research analyst Ben Barringer said: “Growing trade tensions between the US and China put the semiconductor industry in uncertainty, even before the pandemic.

“This shortage illustrates how important certain countries have become in terms of supply chain – and how important access to semiconductors is.”

Lock downs fueled sales of computers and other devices to let people work from home – and they also bought new gadgets to occupy their time off. The automotive industry, meanwhile, initially saw a big dip in demand and cuts its orders. As a result, chipmakers switched over their production lines. But then, in the third quarter of 2020, sales of cars came roaring back more quickly than anticipated, while demand for consumer electronics continued unabated. The rollout of 5G infrastructure is also adding to demand.

Intel is not wasting any time and will invest in a brand new chip plant;

The automotive semiconductor market is expected to increase from $37.4 billion in 2017 to $58.5 billion in 2023, a compound annual growth rate of 7.7 per cent. The overall semiconductor market is expected to have a CAGR of 3.5 per cent, according to researcher IHS Markit. An increase in EV and HEV shipments will boost demand for power semiconductors, especially insulated gate bipolar transistors (IGBT) in the powertrain of electric cars and hybrids. The compound annual growth rate for semiconductors used in powertrains of EVs and hybrid electric vehicles will grow 22 per cent per year from 2017 to 2023, according to IHS Markit.

Jim Feldhan, president of Semico Research, said that standard vehicles today have an average of just under $400 of semiconductors for all electronics systems in vehicles. “With electric cars. the figure pushes up to $2,000 with all the power MOSFETs and other chips. If you make an autonomous car today you are talking about $15,000 worth of semiconductors,” he said.

Air freight

The shortage is further exacerbated by limited air freight capacity. Some high-value items that would normally be delivered by air, such as iPhones, now have to use containers via sea instead, according to Mark Yeager, chief executive officer of Redwood Logistics.

International flight volumes have plunged due to virus and travel restrictions.. “Air freight companies typically use that extra capacity at the belly of a passenger plane. Well, there’s just not very many passenger flights, so not as much air service,” he said. “The lack of options, combined with this crazy amount of demand, has produced this crisis.”

Bike components

“By about May, all hell broke loose,” said Aaron Abrams, Marin Bike’s Taiwan-based product director. ”The big guys were placing orders with everybody, for everything. They would place multiple orders and see who delivered first.”

Remember those non-binding forecasts from the small brands? They went out the window.

“The big guys were placing orders with everybody, for everything”

The factories, most of them, accepted orders on a first-come, first-served basis. And, you’ve heard about it: Lead times went from the typical 45 to 60 days to 300 days, then 350, 450, or even 540 days. A typical bike has 238 different components, so if any one of them has a lead time of 300 days, that means everything has a lead time of 300 days, it’s that simple.

Through last September the average retail price of bike products was up 22%, compared to the same period in 2019, according to NPD Group.

Before the current COVID-19-driven boom, if you can recall, China’s trade wars with the U.S. and Europe dominated industry discussion. There was much talk of building more flexible supply chains and about adding diversity in sourcing.

For years many U.S. brands have been shifting to Southeast Asia, including Cambodia and Vietnam, to escape tariffs on Chinese bikes and rising labor costs in Taiwan.

Even companies based in Taiwan and China looked to establish manufacturing elsewhere. Taiwan’s Giant Group opened a factory in Hungary last year to serve the European market, for example.

However, some of these offshoring plans have been put on hold in the last year because manufacturers are focused on meeting current demand. And opening a new factory in a pandemic is no small challenge.

Rubbing salt to the wound: Brexit

Just one example: Some British clothing retailers are reportedly considering burning stock shipped to the EU that customers want to return because it’s cheaper than hauling it back to the U.K (due to the new customs and tax bills). Economics at play…

Cheers, Pete