A starters pack for your Due Diligence regarding the Tin case.

Updates 04/04/22 & 17/01/23

Let’s walk through the main sides of the Tin market. The idea is to give a rough high-level overview as some kind of ‘Tin starters pack for dummies‘.

“The Tin in your phone is worth a few cents. Will you balk if that becomes a couple more cents? Of course not”

Why this post? Tin is hot & as a niche commodity, the general coverage is low and fragmented. See it as a humble attempt from yours truly to support anyone’s due diligence. I’m a retail investor so that is my angle and retail is the main target audience. This first article will cover the basics. Real-time discussions can be found on Twitter #tin.

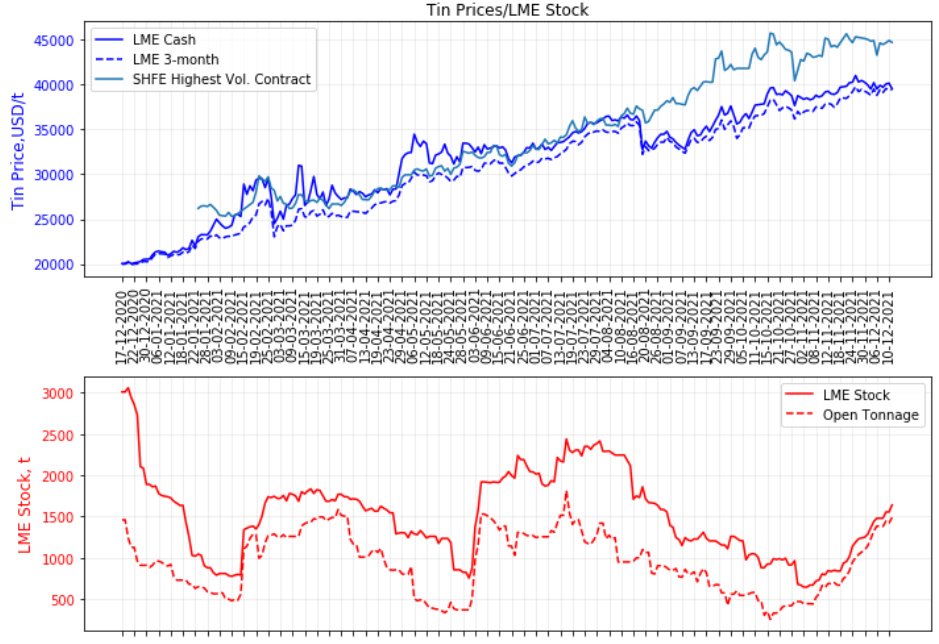

Where to start? Tin prices have been swinging widely from sub $15k/t to +$40k/t to $18k/tin and back to $28k/t in the last two years. Enough of a reason to have a look under the hood. Here the chart;

“The symbol Sn for tin is an abbreviation of the Latin word for tin, stannum“

Demand

Let’s kick off with the most used chart in the industry right away. Rio Tinto, through research by Boston’s Massachusetts Institute of Technology (MIT), has detailed the metals that are expected to be the most impacted by new technology (2018).

According to this graph, tin is predicted by MIT to be the metal that will be most affected by technology. The scoring system is a homecooked recipe including ‘substitution risk’, ‘Technological disruption risk’ & ‘Potential demand change vs current market size’. It is that last one that helped put Tin on spot number one. It’s a small, niche market.

To show the context of the size of the Tin market;

Current Applications

Tin is used in many forms. It takes a high polish and is used to coat other metals to prevent corrosion, such as in tin cans, which are made of tin-coated steel. Alloys of tin are important, such as soft solder, bronze, and phosphor bronze. A niobium-tin alloy is used for superconducting magnets. Most window glass is made by floating molten glass on molten tin to produce a flat surface. Tin salts sprayed onto glass are used to produce electrically conductive coatings. The most important tin salt used is tin(II) chloride, which is used as a reducing agent and as a mordant for dyeing calico and silk. Tin(IV) oxide is used for ceramics and gas sensors. Zinc stannate (Zn2SnO4) is a fire-retardant used in plastics.

The list goes on and on, you get the picture. We zoom in on the top applications;

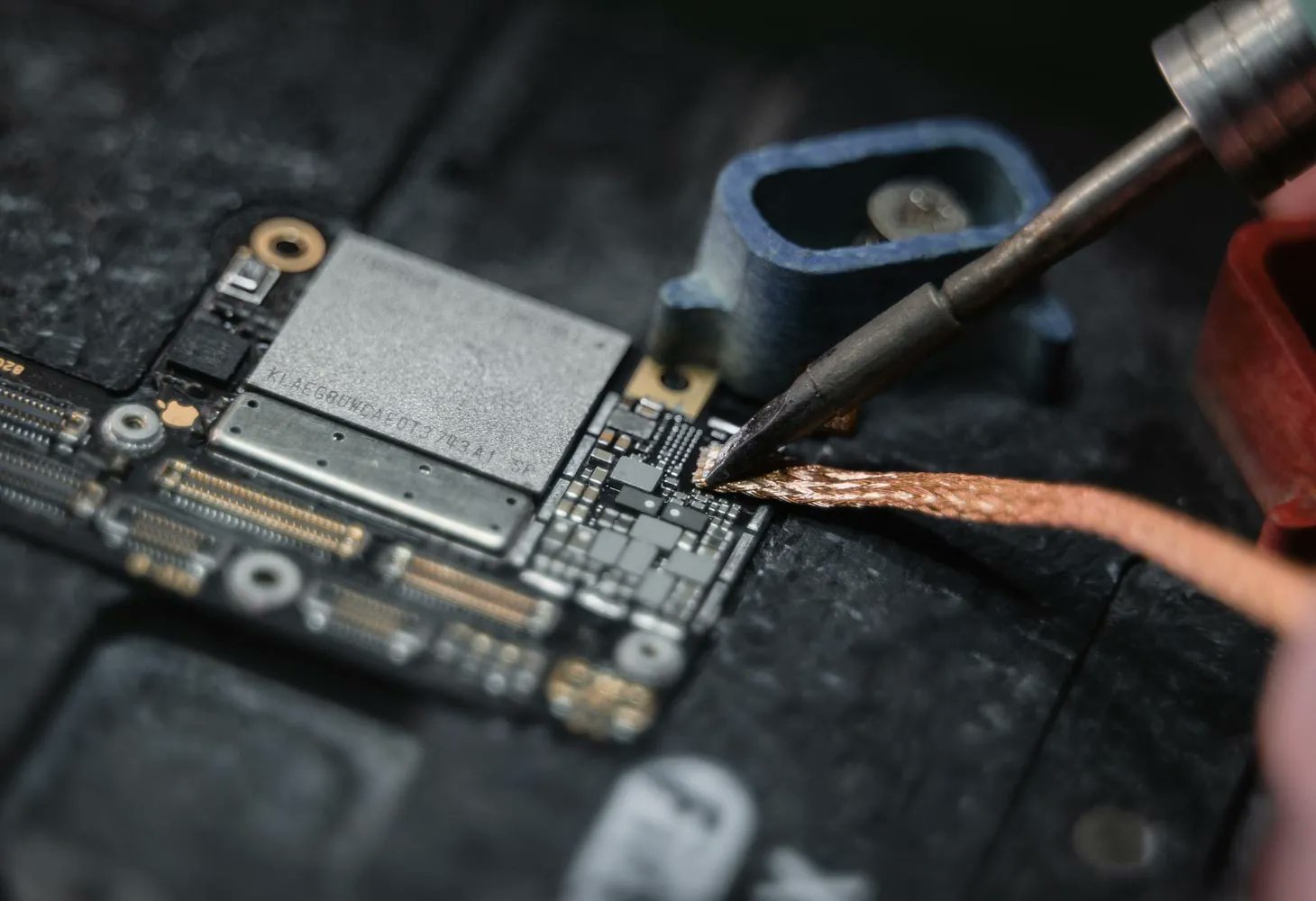

Solder for the semiconductor industry

Solder consumption has grown rapidly over the past decade and has replaced tinplate as the largest area of tin consumption. Tin welding is mainly used in the electronic semiconductor industry, although the global electronic components show the characteristics of miniaturization (smaller chips = less solder usage), the increase of single equipment components does not significantly reduce the total consumption of electronic solder.

“Tin, the glue of metals”

In addition to the traditional field, it is expected that more tin will be widely used in modern society as catalytic, sensing, optoelectronics, and energy storage materials in the future. At present, many research institutions in the world (especially in China) mainly focus on tin solar film, nano-tin oxide lithium-ion batteries, tin-based catalytic materials, and so on.

There are plenty of forecasts out there on semiconductor growth, I picked one;

This growth is (partially) attributable to the increased market share of EV’s, the roll-out of 5G, the Internet Of Things, more Smart home devices, automatization & robotica, advanced computing, cloud storage & the use as Solar Ribbons in solar panels.

“Electrification of the world will need microchips. Lots of them. Period.”

Each one of these markets deserves a separate article & forecast. There are plenty to be found online, I’ll stick to the bottom line: The semiconductor industry has grown fast & will continue to grow at a fast pace. CAGR forecast range from 2-9%.

“Total Semiconductor content in a 5G phone is 30-40% higher than in the current 4G phones.” (Source: L1 Capital Int. Q1 ’21 report)

I want to briefly mention one crucial point in time for tin. In 2004, new environmental regulations in Japan & the EU required manufacturers to curb the use of lead in circuit boards for electronics. This has proved to be a boost for the most common lead-free solder mix of tin-copper.

Tinplates

Tin is a highly crystalline, ductile, metal container used for food preservation for long periods of time. Or long story short: Yes, it’s all about them tin cans.

Supply

Know that Tin is not a scarce metal, its presence is plentiful, yet it does take time & investments to find & process it. This is a key consideration in the strong current price uptrend.

Let’s dig in…

Deposit types

1. The main types of primary tin deposits are as follows (as per SMM the leading metals info provider in China):

(1) the tin-bearing pegmatite deposit is mainly small and medium-sized, with low tin grade, but the ore is easy to be separated and the recovery rate is high. Mainly distributed in Africa, Brazil, Australia and other places. About 10 per cent of the world’s tin production comes from such deposits.

(2) the cassiterite-quartz vein deposits are mainly small and medium-sized, a few large and a few super large. This kind of deposit has high ore grade, easy separation and recovery rate of 70% to 80%. Most deposits can be mined in open pit. Mainly distributed in Southeast Asia and Europe.

(3) cassiterite-sulfide deposits, mostly large and medium-sized, a few super-large. The ore contains 0.2% and 1.5% tin, most of which are underground mining, the mineral processing process is complex, and the recovery rate is low (generally 30% to 60%). Such deposits are mainly distributed in China, Bolivia and the northeast coastal areas of Russia.

(4) Sand tin deposits, generally small and medium-sized, but also large and super large. The ore contains 0.05% and 0.3% tin, mostly open mining, the mineral processing process is simple, and the recovery rate is generally 50% to 95%. Mainly distributed in Southeast Asia, Central and South Africa, Australia and other places.

Regions

If you are a jurisdictional risk-averse person, please sit down first.

1. The SE Asian tin belt (Myanmar, Thailand, Malaysia, Indonesia) with a 40–45% share of the total world tin production

2. The South China tin province (20%)

3. The Central Andean tin belt (Bolivia and southernmost Peru) (14%)

4. The Cornwall (UK) tin province (7%)

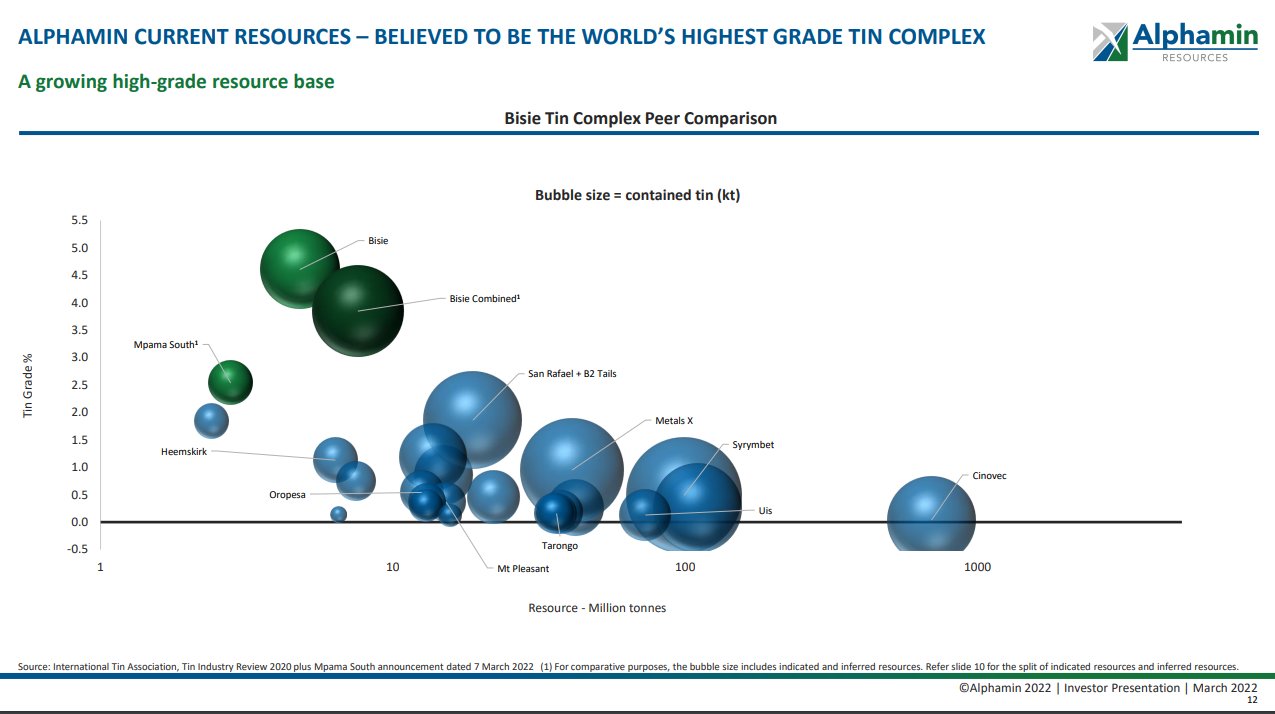

5. The DRC, has many artisanal cassiterite mines. An IPIS 2021 Report shows +28.000 miners are involved in these mines. A special mention for Alphamin Resources that is producing 4% of global mined tin (2021) at their Bisie mine in North Kivu.

These five regions account for about 85% of the current global tin mine production and two-thirds of the tin reserves (USGS, 2020)

Throwing that into some graphs:

A more elaborate analysis of the world Tin resources & reserves can be found here.

Making it more real, here is a picture of offshore Tin mining in Indonesia, doesn’t seem very professional & efficient nor environmentally friendly now does it?

Cost curve

Recycling

Overall, the end-of-life recycling of Tin stands at roughly 20%*

Unfortunately, most of the tin mined globally in the 20th century has been accumulating in landfills due to a relatively short lifetime (12 years) and low recovery rates.

“Waste from Electrical and Electronic Equipment” (WEE) stands at roughly 15-20%. The recovery from Tin thereof is basically zero (2017 data) . Technically it is possible to recover +85% of the Tin, it just hasn’t been done as not economical, maybe that will change with current Tin price appreciation.

Tin in chemicals: Recycling practically ZERO as tin is used here in low concentrations

Tin in batteries, bronze & brass: Recovery can be almost 100% (debatable how realistic that practically is)

*All data from ‘Governance of The World’s Mineral Resources: Beyond the Foreseeable Future, By Theo Henckens‘

Forecasts

I’ll throw in a couple so you get a sense of the common theme here.

Alphamin Resources made a decent short pro/con analysis on the Tin sector:

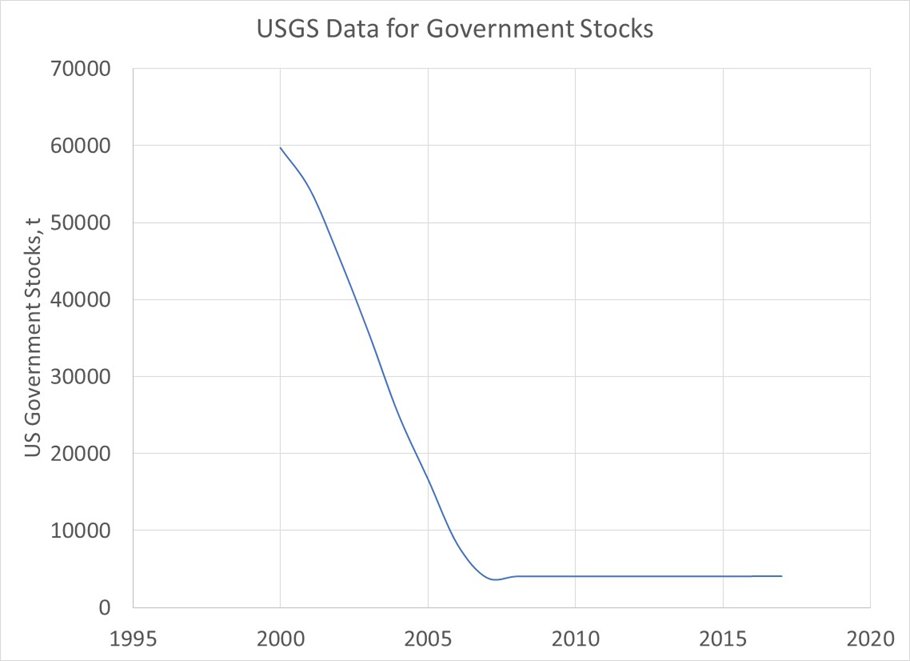

For our American friends

For 2020, Roughly 77% of America’s tin supply was imported from foreign countries – Indonesia (24%), Malaysia (21%), Peru (20%), and Bolivia (17%) were the top suppliers of tin to the U.S. The balance of U.S. tin supply, roughly 18,000 metric tons, was the product of recycling. “Tin has not been mined or smelted in the United States since 1993 and 1989, respectively,” USGS inked in its Mineral Commodity Summaries 2021 publication.

In March 2021, the US Defense Logistics Agency has authorized to sell about 4,000 tonnes of tin from the US government stockpile. But in a domestic market that consumes more than 40,000 tonnes of tin a year, US tin consumers did not take great comfort from a one-off 1% increase in supply.

Inventories

Let’s get some abbreviations out of the way first;

LME: London Metal Exchange

SHFE: Shanghai Futures Exchange

COMEX: Commodity Exchange (Manhattan)

Simply put: These exchanges hold stock of different metals in their warehouses to smoothen out the global flow of metals, ease of transactions, keep supply on the shelves, etc. What we are seeing today, is that just a few days of supply is available (count 1000t/day). History has shown us anything below 10 days is worrisome & cause for attention. This has become painfully visible in the backwardation* we recently saw in the market. LME inventories reached their low point in November at just 670 tonnes. The end of December 2022 data shows inventories have recovered somewhat from their lows;

*Backwardation is when the current price of an underlying asset is higher than prices trading in the futures market. Backwardation can occur as a result of a higher demand for an asset currently than the contracts maturing in the coming months through the futures market (Investopedia for the win).

History – A teaser

Sometime around 3500 BC, Sumerians living in modern-day Turkey and Iran discovered that mixing a little tin with copper created bronze, an alloy that produced much more durable weapons and tools than those cast from copper alone.

This cutting-edge discovery offered a strategic and economic advantage over those who did not possess the ingredients or skills to make this copper-tin alloy. The benefits offered by this metallurgical technology were so profound that we now consider the Bronze Age one of the most important epochs of human history, an era that spans more than 2,000 years (more here).

As I said, a teaser, its history is long but I want to keep this article somewhat short.

Tinbarons

Real-time discussions on Tin & relevant stocks can be found on Twitter. The #tinbaron hashtag is in good fun with a clever and tuned-in crowd. #Tin

Starters Pack: Equity

As I’m obviously biased, I’ll restrict myself to one overview slide per company, the rest is up to you. There are a few more companies out there, yet I personally believe this is a great first group to have a look at;

Those interested to wade through some of the actual Tin mines, developments & prospects, know that the only economically important tin mineral is cassiterite (SnO2), which is a heavy mineral (7.15 g/cm3) and mechanically and chemically resistant. There are another 5 articles to be written on this… for another author, another time. The real nerds can start here and/or with the below data points;

Correlation with Doctor Copper

Are there threats to tin?*

Threats to tin demand are principally from cost reduction, through reduced usage and substitution with cheaper materials, and health regulations.

Circuit designers strive to use fewer components and to miniaturize the electronic footprint of gadgets; both these trends reduce the amount of solder needed. At the same time, epoxy resins can hold components in place, though some soldering is still needed to provide conductivity. Although using epoxy resins adds complexity to assembly, for large components it can make financial sense.

In chemicals, the threat comes from cheaper alternatives or the need to comply with regulatory pressures. For example, zinc–calcium compounds can be used as a PVC stabiliser, even if performance is inferior. These also bring compliance with various regulations, such as the EU REACH and food-contact legislation.

Tinplate is under more direct threat. Plastic bottles and aluminium have been eroding the demand for tin cans for many years. In 2016, 90% of cans for both food and beverages were made from aluminium, the rest from tinplate. However, with as many as 80bn cans made annually, tinplate is still used in 8bn of them.

*https://www.edisongroup.com/edison-explains/tin/

Useful Links

Here are a few more good summaries from recent months. One by the ITA, International Tin Association, with many data points. One by Dominic Frisby a well-known all-around British commentator. And One by Christopher Ecclestone over at Hallgarten who was the first analyst to put out coverage on Alphamin Resources.

A write-up by Joel Schopp: https://latinmines.com/lithium-hard-rocks/

Edit: Adding this brilliant overview by Brian Laks, partner at Old West Invest Management: https://youtu.be/XJdu2byU6AY

Tin Futures: https://www.investing.com/commodities/tin

LME Tin info & prices: https://www.lme.com/en/Metals/Non-ferrous/LME-Tin

International Tin Association: https://www.internationaltin.org/

Mark Thompson thread: https://threadreaderapp.com/thread/1386614024385744897.html

Peter Tinbaron’s thread: https://twitter.com/Peter52834033/status/1420210740493836293

If you liked the ‘Tin for Dummies‘, my Beer tab is ALWAYS open: http://paypal.me/petepandapayup

Sources

https://www.internationaltin.org/

https://threadreaderapp.com/thread/1386614024385744897.html

2020 Report on Global Tin Resources & Reserves (internationaltin.org)

https://www.sciencedirect.com/science/article/pii/S0024493720303935

Book “Governance of The World’s Mineral Resources: Beyond the Foreseeable Future” -By Theo Henckens

DISCLAIMER: This is not investment advice, however, I strongly recommend you to have a closer look yourself. The author is irresponsibly long Alphamoon.

See how you can earn $27 in 7 minutes! Read here – https://bit.ly/32NSumo

Hello, recognition you looking for facts! I repost in Facebook

Really nice layout and great articles , practically nothing else we want : D.

I truly enjoy looking at on this web site, it holds excellent content. “The living is a species of the dead and not a very attractive one.” by Friedrich Wilhelm Nietzsche.

great page; https://main7.net/%ec%83%8c%ec%a6%88%ec%b9%b4%ec%a7%80%eb%85%b8/

Nice answer back in return of this question with solid arguments and explaining the whole thing on the topic of that.

Valuable info. Lucky me I found your site by chance, and I’m surprised why this twist of fate did not happened in advance! I bookmarked it.

visit my page; https://amd1080.com/